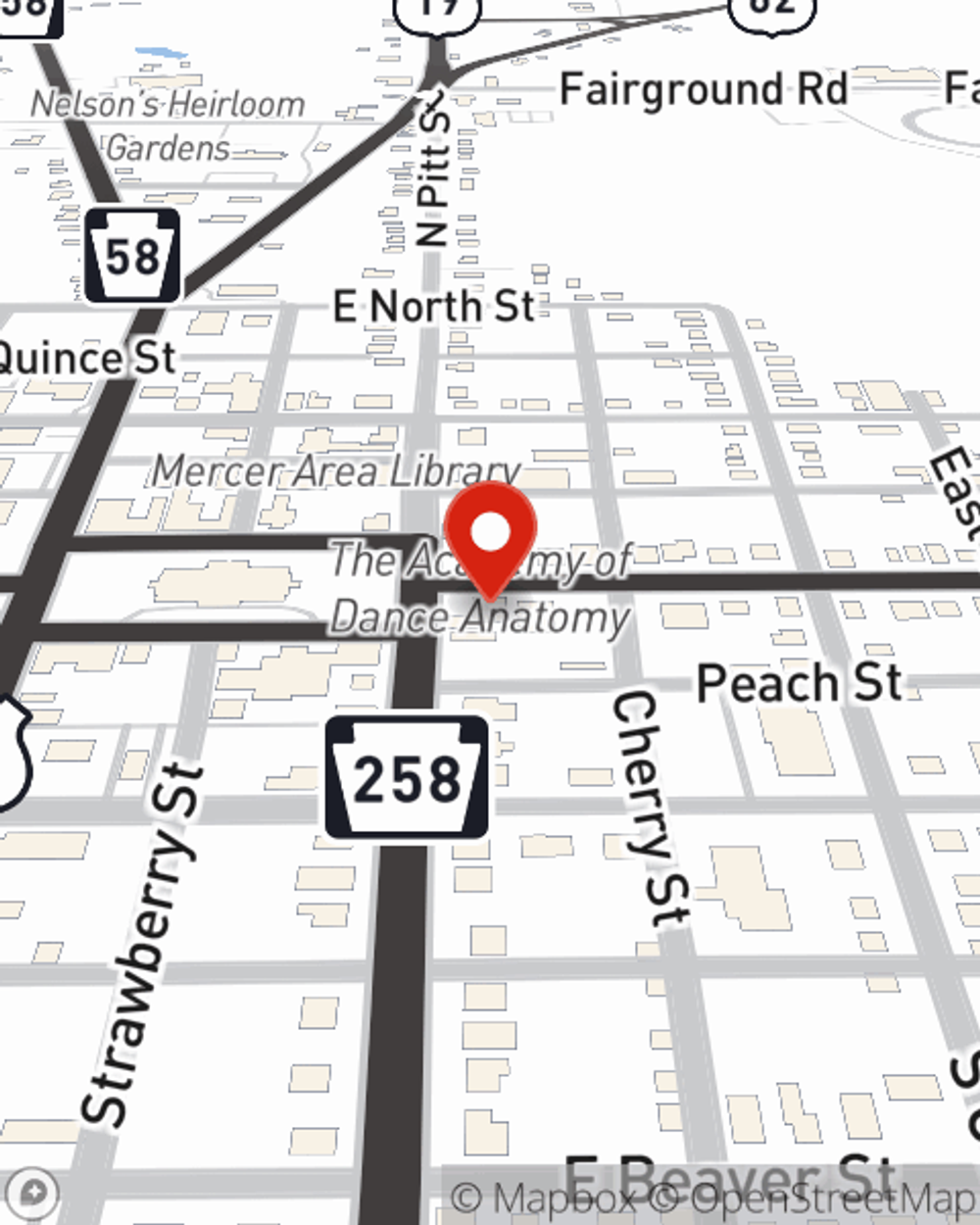

Business Insurance in and around Mercer

Calling all small business owners of Mercer!

Helping insure small businesses since 1935

Business Insurance At A Great Price!

When experiencing the highs and lows of small business ownership, let State Farm do what they do well and help provide outstanding insurance for your business. Your policy can include options such as a surety or fidelity bond, business continuity plans, and extra liability coverage.

Calling all small business owners of Mercer!

Helping insure small businesses since 1935

Protect Your Future With State Farm

When you've put so much personal interest in a small business like yours, whether it's an arts and crafts store, a barber shop, or a dry cleaner, having the right coverage for you is important. As a business owner, as well, State Farm agent Tom Jones understands and is happy to offer customizable insurance options to fit your business.

Agent Tom Jones is here to discuss your business insurance options with you. Call or email Tom Jones today!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tom Jones

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.